Missing!

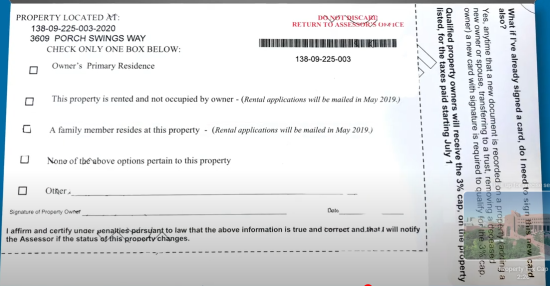

In Clark County Nevada, property taxes are capped at 3% for primary residence and 8% for all other types of owners. Taxes are based on value but when values are skyrocketing, it is nice to have a cap in place.

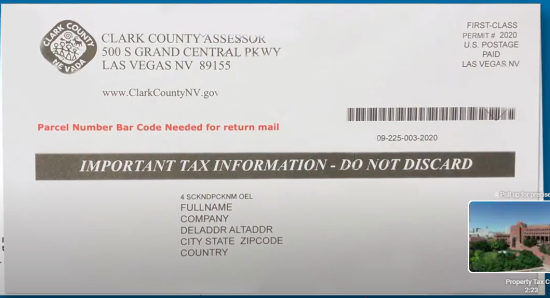

In the spring, the Assessor's office mails out cards to verify what type of occupant you are. This video from Clark County shows an example. In addition, here are some screenshots:

· If you didn't receive or you discarded because it looked like 'fake news' call their office and ask for another one.

o They don't have blank forms available, you have to call, answer some questions and they mail you a form

o Assessor's office: 702-455-3882

· If you received and mailed it back

o Be sure to check on it before the year's cutoff of June 30th to ensure it is properly updated. (Fiscal year is July 1 - June 30)

· To check your cap rate:

o Go to the Treasurer's search page.

o Search by Parcel, Name, or Address.

o On the next page, click on your the Parcel ID

o The next page, look for the "tax cap increase pct" (left hand side, under the address a tad).